On November 15, the Ministry of Finance and the State Administration of Taxation issued an announcement regarding the adjustment of the export tax rebate policy.

The announcement states that the export tax rebate rate for some refined oil products, photovoltaics, batteries, and certain non-metallic mineral products will be reduced from 13% to 9%.

This announcement will come into effect on December 1, 2024. The applicable export tax rebate rate for the products listed in this announcement is determined by the export date indicated on the export goods declaration form.

The original file is as follows:

Announcement on Adjusting the Export Tax Refund Policy

Announcement No. 15 of 2024 by the Ministry of Finance and the State Administration of Taxation

The following is the announcement regarding the adjustment of export tax rebate policies for aluminum and other products:

1. Export tax rebates for aluminum, copper, and chemically modified animal, plant, or microbial oils, fats, and other products are canceled. Please refer to Attachment 1 for the specific product list.

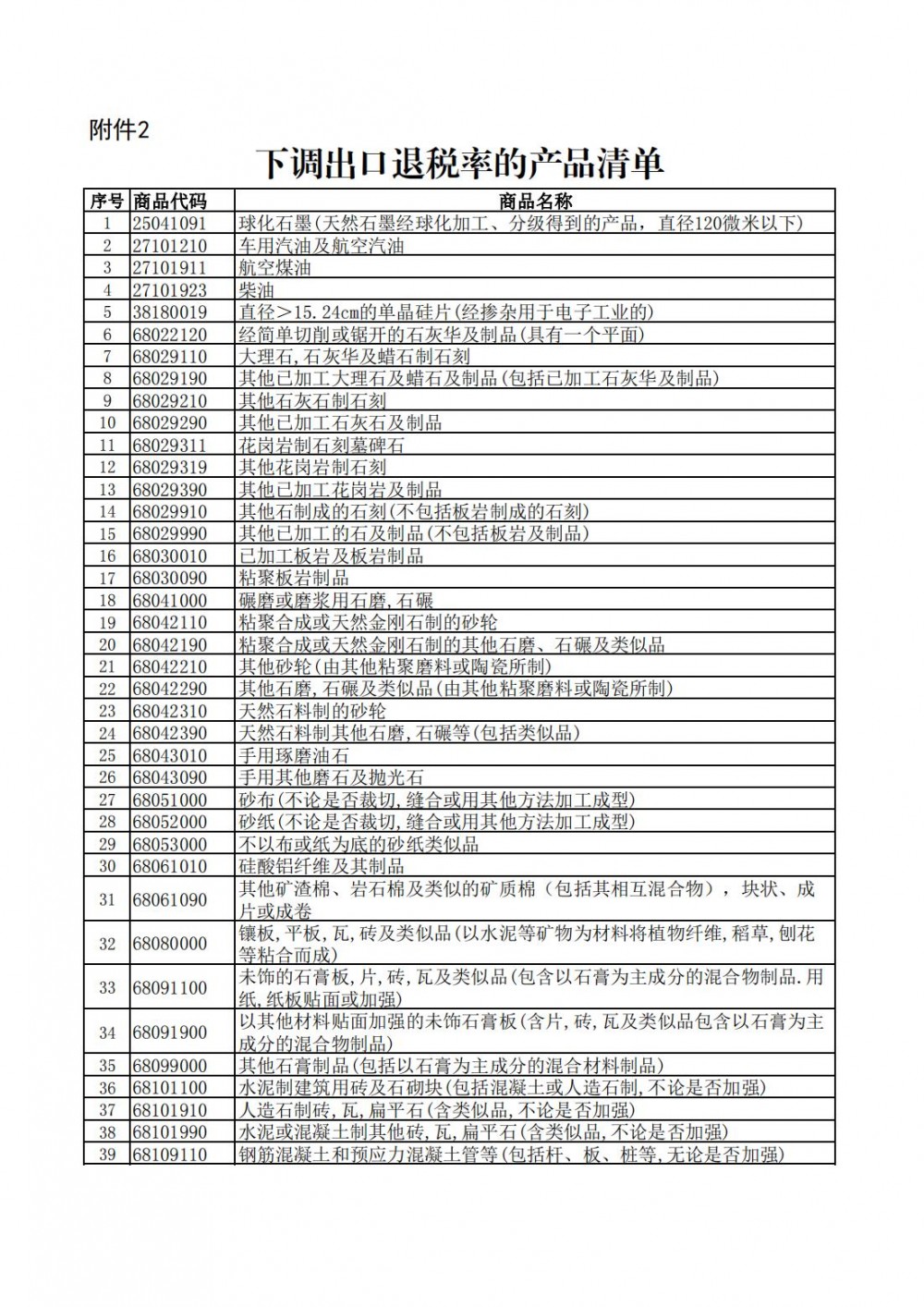

2. The export tax rebate rate for some finished oil products, photovoltaics, batteries, and some non-metallic mineral products is reduced from 13% to 9%. Please refer to Attachment 2 for the specific product list.

3. This announcement will come into effect on December 1, 2024. The applicable export tax rebate rate for the products listed in this announcement is determined by the export date indicated on the export goods declaration form. This is to announce.

Ministry of Finance, State Administration of Taxation

November 15, 2024