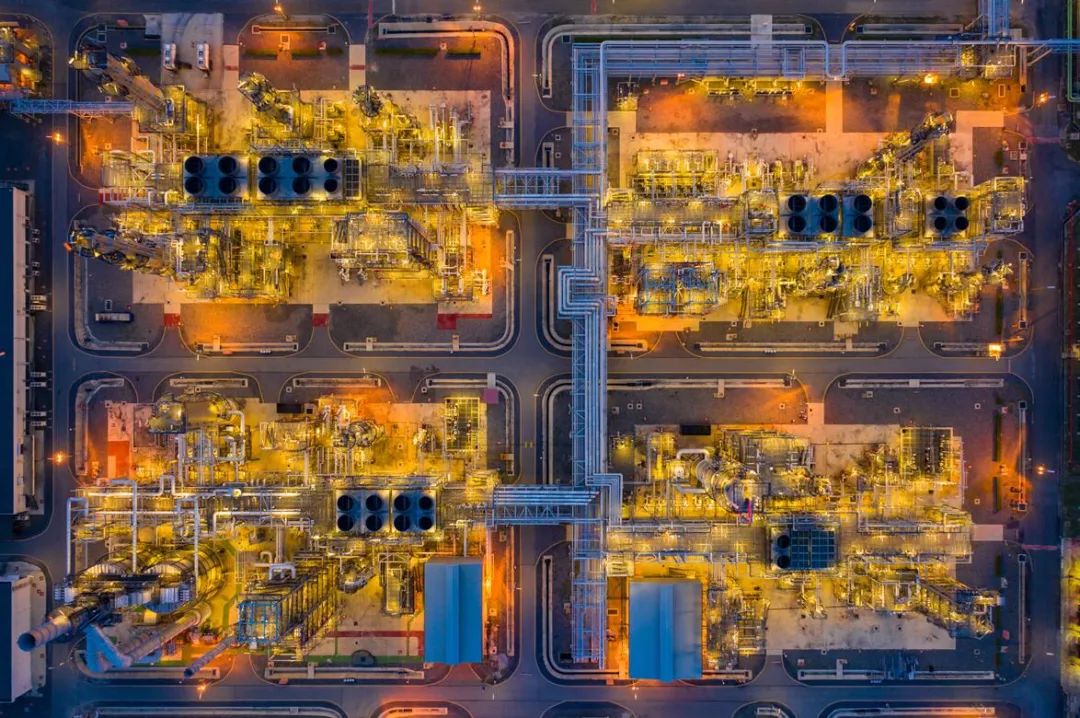

Over the past decade, significant changes have taken place in the expansion of refined oil production capacity, shifts in supply and demand, price trends, and policy orientation.

Over the past decade, notable changes have occurred in various aspects such as the expansion of refined oil production capacity, changes in the supply-demand landscape, price trends, and national policy directions. The year 2024 is a pivotal year for the 14th Five-Year Plan, and refining capacity is expected to peak by 2025. Amid tightening compliance policies, the acceleration of the new energy industry, and escalating geopolitical issues, where is the refined oil industry headed?

01 Large-scale refining and petrochemical projects are gradually being implemented.

From 2014 to 2023, domestic atmospheric and vacuum distillation production capacity exhibited a fluctuating upward trend, rising from 764 million tons in 2014 to 984 million tons in 2023, an increase of 220 million tons over the decade. The compound annual growth rate of China's primary production capacity is 2.85%. The growth in production capacity was primarily concentrated between 2019 and 2021. The centralized commissioning of large-scale refining projects was the main driver of the rapid growth in production capacity. In 2022, refining capacity experienced its first decline, mainly due to the consolidation of refining enterprises, increased idle refining capacity in Northeast China, Xinjiang, and South China, and the demolition of some refineries in Shandong and other regions, resulting in a significant reduction in the number of refineries. In 2023, the increase in production capacity primarily came from Jingbo Petrochemical's newly built refinery in Hainan. In 2023, China had a total of 162 refineries, a decrease of 1.82% compared to 2022, but the total crude oil processing capacity was approximately 984 million tons per year, an increase of 0.18% compared to 2022. Currently, China leads the world in refining capacity, with its crude oil processing capacity ranking first globally. In terms of regional distribution, it is mainly concentrated in East China, South China, and Northeast China, benefiting from their coastal advantages. Among them, East China accounts for 44.69% of the total production capacity. The slowdown in the growth rate of gasoline and diesel consumption has forced refineries to adjust their gasoline and diesel production ratios to alleviate supply and demand pressures. Consumption data from the National Bureau of Statistics showed a decline from 2018 to 2021, consistent with the downward trend in production. According to Longzhong's consumption data, consumption decreased by 0.69%, 2.37%, and 8.61% year-on-year in 2018, 2020, and 2022, respectively. This aligns with the gasoline and diesel consumption demand at that time. In 2020 and 2022, gasoline and diesel consumption significantly declined due to the impact of the epidemic. Since 2023, with the comprehensive lifting of epidemic prevention and control measures, the volume of car travel has experienced explosive growth. Despite some impact from new energy vehicles, gasoline consumption remains strong. Various indicators such as transportation, logistics, and PMI suggest that the current diesel market lacks new demand and needs to enhance its endogenous power. The refined oil industry is relatively concentrated, with the market share of production and sales primarily held by major players. In terms of production capacity distribution, the main business accounts for 142 million tons, and private enterprises account for 84 million tons. The main business accounts for 62.83%, occupying a dominant position.

02 Excess supply of finished oil.

In terms of the gasoline consumption structure, in 2023, the transportation, warehousing, and postal industries accounted for the largest proportion of gasoline applications, reaching 44% of the total consumption structure. In 2023, the total number of vehicles in China reached 336 million, a year-on-year increase of 5.73%. Thanks to preferential policies encouraging the consumption of passenger cars, car sales maintained good momentum throughout the year. The steady growth in vehicle ownership has provided strong support for domestic gasoline terminal consumption. The number of new energy vehicles reached 20.41 million, accounting for 6.07% of the total number of vehicles; within the year, 7.43 million new energy vehicles were newly registered, a year-on-year increase of 38.76%. In 2023, stimulated by the relaxation of epidemic prevention and control policies, the transportation and postal industries recovered significantly. However, the rapid growth trend of new energy vehicles in 2023, with their application areas concentrated in public transportation such as taxis, significantly increased the substitution rate for gasoline consumption, to some extent inhibiting the increase in the proportion of transportation. Affected by the comprehensive relaxation of epidemic prevention and control measures, residents' willingness to travel has increased, and the consumption ratio has slightly increased year-on-year. Due to the overall sluggish performance, the consumption ratio in the construction and industrial sectors has slightly decreased. The consumption ratio in other industries remains basically unchanged. In terms of the diesel consumption structure, in 2023, diesel consumption accounted for 65% in the transportation sector, making it the largest consumption area for diesel products. The agricultural, forestry, animal husbandry, and fishery sectors accounted for 11% of total consumption, while consumption in the industrial, construction, and daily life sectors accounted for 9%, 3%, and 5% of total diesel consumption, respectively. The total diesel consumption in other industries accounted for 7%. In the field of diesel consumption, the demand for warehousing and logistics is the main source. In 2023, due to the impact of the real estate recession, diesel consumption in the construction and infrastructure sector was lower than in previous years. Subsequently, the demand for diesel in the industrial, agricultural, forestry, animal husbandry, and fishery sectors, as well as in the consumer goods sector, has entered a downward trend.

03 Prices under pressure ahead.

In the past decade, the average price of China's diesel market has basically followed a "W" trend. The low point for gasoline prices was 4973 yuan/ton in mid-May 2020, and the high point was 10253 yuan/ton in early March 2022. The low point for diesel prices was 4210 yuan/ton in early April 2016, and the high point was 9133 yuan/ton in November 2022. From 2014 to 2016, China's newly added production capacity increased, but demand growth was moderate, leading to an oversupply of market resources and consecutive declines in refined oil prices. During this period, influenced by factors such as the decline in international oil prices and structural overcapacity in refining, gasoline and diesel markets simultaneously turned downward, with diesel prices falling to their lowest level in nearly a decade in April 2016. It was not until the second half of 2017 that the refined oil market resumed its upward trend, supported by enhanced cost-side support, new tax policies, and a tightening of domestic supply and demand relationships. However, starting from October 2018, with the continuous decline in crude oil prices, market buying and selling enthusiasm significantly weakened. In addition, coupled with the concentrated release of domestic refining capacity of tens of millions of tons in 2019, the pressure on domestic supply and demand became increasingly prominent, and refined oil prices once again entered a downward channel. In 2020, the COVID-19 crisis wreaked havoc globally, causing a precipitous decline in refined oil prices due to the collapse of the cost side. Downstream consumption almost stagnated, and gasoline prices fell to their lowest level in a decade. Between 2021 and 2022, with the strengthening of crude oil prices, the gradual relaxation of epidemic control measures, and continuously improving consumption expectations, both gasoline and diesel prices reached new highs in nearly a decade in 2022. Since 2023, international geopolitical instability has significantly intensified cost fluctuations, and some market expectations have been prematurely overdrawn, causing the refined oil market to remain under pressure.